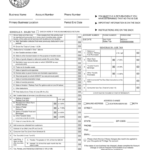

City And County Of Denver Quarterly Sales Tax Form – If you intend to move to the county is to register your car, the initial step. You can sign-up on the internet or by mailing the signing up develop towards the federal government office. By May 1st, you must also declare your watercraft. Continue reading to find out more. Here are some of the crucial forms you will demand.

corporate and business private residence taxation on tangible

You must have all the details regarding the tangible property owned by the firm in order to complete your county tax forms for the business tangible personal property tax. This includes any concrete property, like furniture, tools, machinery and computers portable houses, billboards, and other business office products. It really is important to understand that some types of concrete property are considered intangible and they are not at the mercy of taxation. Some examples are inventory and software for pc programs.

The Commissioner of Profits mails you the Tax Return for Business Tangible Private Business and Property Tools and Machinery. To protect yourself from a ten percent charges, the form must be done by Mar primary. The level of the punishment cannot be higher than the to be paid taxes.

You must annually update your business records in order to stay clear of fines. Even though your small business had not been open on January 1 of the present income tax season, this still keeps correct. The duty to publish a taxes for the prior season nevertheless pertains to businesses that had been working on Jan 1.

Tax return for organization concrete private residence

Each and every year, businesses in Prince William County have to distribute a Business Real Private Residence Taxes. Things which includes machinery and tools, standard place of work home furniture and items, computer hardware, and add-ons are all subject to these levies. These products will need to have a Tax payer Recognition Number (TIN) about the return. Those who own organizations need to digitally or actually data file their tax statements.

Businesses must include all objects that were purchased for the purpose of operating a business, including furniture, office equipment, cell phones, copiers, shop equipment, and machinery, in order to record their tangible personal property. Various perceptible personalized house which had been received cheaper than $500 ought to be shown by businesses. Leasehold improvements shouldn’t be categorized under this heading, because they are affixed to a building and do not qualify as personal property.

All real personal property employed in a business should be detailed with the original cost. The cost of the piece including a established sum for devaluation in accordance with the year it had been acquired make up the taxable assessed value. The Freeport Exemption quantity supplied below O.C.G.A.SS 48-5-48.2 is just not contained in this valuation. Firms must include business tangible personal property with the original purchase price, as an alternative.

Contractors’ company concrete private residence tax return

You should restore your merged-consume allow by Mar 1 each year in addition to filing your Region real private residence taxes. On January very first, you have to also announce your industrial real-estate in Loudoun Area. The Table of Supervisors establishes the taxes prices that affect county contractors and businesses.

Supplies used by a contractor in order to complete a job are termed as concrete personalized property. It includestools and machinery, and cars. These products are regarded as perceptible residence and they are chargeable with product sales taxation. In order to be eligible, these things need to be connected to real estate.

Revenue income tax on the sale of real personal property must be paid for from a contractor who tends to make fixes on it. The service could include creating repairs or upgrades to the real estate. If a contractor sells new baseboards and trim while installing them, he can be required to pay sales tax. If they add stained baseboards or repaint existing ones, the contractor is exempt from collecting sales tax, however.

Give back of business real individual house for architects and engineers

engineers and Architects should data file company perceptible personal property tax statements every single October. Tax returns for real individual house owned by organizations must be submitted by Feb 15 following July 1. However, the deadline is February 15 if you bought a new car after July 1. Whatever the case, repayment arrives from the next working day.

Your office space is a component of your business if you are an architect or engineer. You need to send an annual record in accordance with Virginia law. Your real private property for your business includes furnishings, tools and computers and large items. According to tax requirements, you must disclose any property you use on a temporary basis or that was given to you. For federal government tax motives, you should in addition declare things which were completely depreciated.