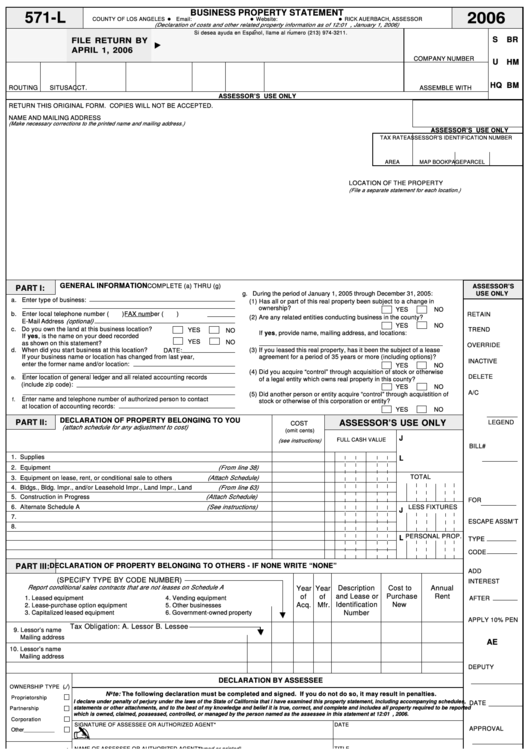

Los Angeles County Property Tax Form – The initial step if you intend to move to the county is to register your car. You may register on the web or by mailing the signing up kind to the government workplace. You must also declare your watercraft, by May 1st. Read on to learn more. Here are some in the crucial forms you can expect to demand.

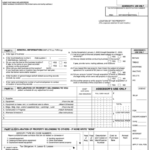

corporate and business personal residence taxation on real

In order to complete your county tax forms for the business tangible personal property tax, you must have all the details regarding the tangible property owned by the firm. This can include any real residence, for example furnishings, machinery, computers and tools mobile phone homes, advertisements, as well as other place of work items. It is actually substantial to understand that some types of real home are regarded intangible and so are not subject to taxation. Included in this are inventory and software for laptop or computer software.

The Commissioner of Income e-mails you the Taxes for Enterprise Real Individual Business and Property Tools and Machinery. In order to avoid a ten percent fees, the form should be finished by Mar 1st. The amount of the fees should not be greater than the owed taxes.

You must annually update your business records in order to stay clear of fines. Even though your organization was not wide open on Jan 1 of the recent taxation year, this continue to holds true. The job to submit a taxes for your before 12 months still pertains to businesses that were operating on January 1.

Tax return for enterprise perceptible individual home

Annually, businesses in Prince William Area must distribute an enterprise Concrete Personalized Property Tax Return. Products which include tools and machinery, regular office home furniture and items, computer hardware, and peripheral devices are all subject to these levies. These materials must have a Taxpayer Id Number (TIN) around the profit. Those who own companies must electronically or actually data file their tax returns.

Businesses must include all objects that were purchased for the purpose of operating a business, including furniture, office equipment, cell phones, copiers, shop equipment, and machinery, in order to record their tangible personal property. Miscellaneous real private residence which had been purchased for less than $500 should also be detailed by companies. However, because they are affixed to a building and do not qualify as personal property, leasehold improvements shouldn’t be categorized under this heading.

All perceptible personal house used in an enterprise has to be listed together with the original expense. The price of the goods including a set volume for depreciation in accordance with the calendar year it was actually purchased make up the taxable assessed benefit. The Freeport Exemption amount provided under O.C.G.A.SS 48-5-48.2 is not included in this valuation. Firms must include business tangible personal property with the original purchase price, as an alternative.

Contractors’ business tangible personal house taxes

You have to renew your combined-consume permit by March 1 each and every year in addition to filing your State perceptible personalized residence tax return. On Jan 1st, you have to also express all of your current professional real estate property in Loudoun County. The Table of Supervisors establishes the tax rates that pertain to area businesses and contractors.

Resources used by a licensed contractor to end a task are referred to as real individual home. It is made up ofmachinery and tools, and automobiles. These products are regarded as real home and they are chargeable with sales taxation. In order to be eligible, these things need to be connected to real estate.

Revenue taxation on the sale of real personalized residence has to be paid out from a licensed contractor who can make fixes with it. The assistance could require producing repairs or changes to the real estate. He can be required to pay sales tax if a contractor sells new baseboards and trim while installing them. However, the contractor is exempt from collecting sales tax if they add stained baseboards or repaint existing ones.

Return of economic concrete individual residence for engineers and architects

engineers and Architects should submit company perceptible personalized house tax returns each and every October. Tax statements for real personalized home belonging to organizations should be submitted by Feb . 15 right after July 1. If you bought a new car after July 1, the deadline is February 15, however. Regardless, settlement is due from the next business day.

Your office space is a component of your business if you are an architect or engineer. You have to distribute a yearly statement as outlined by Virginia legislation. Your real private residence to your organization includes tools, computers and furnishings and huge items. According to tax requirements, you must disclose any property you use on a temporary basis or that was given to you. For federal government taxation reasons, you have to additionally express things which were entirely depreciated.