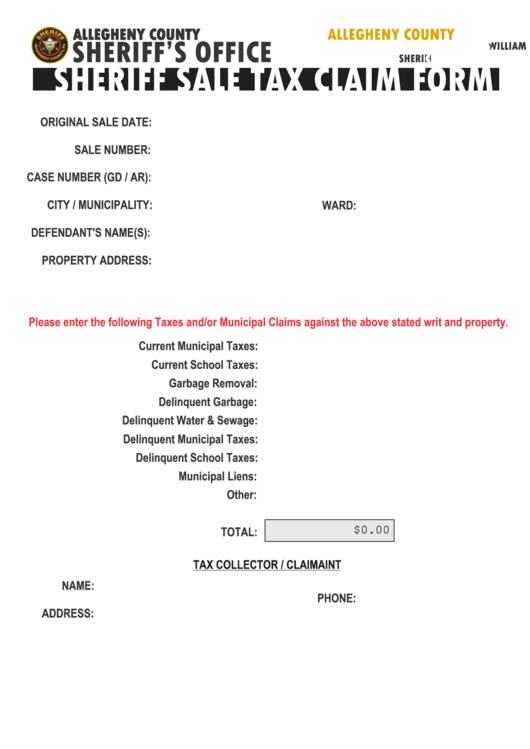

Allegheny County Local Income Tax Form

Allegheny County Local Income Tax Form – The initial step if you intend to move to the county is to register your car. You are able to sign-up online or by mailing the signing up develop for the federal government business office. By May 1st, you must also declare your watercraft. Read on to acquire … Read more